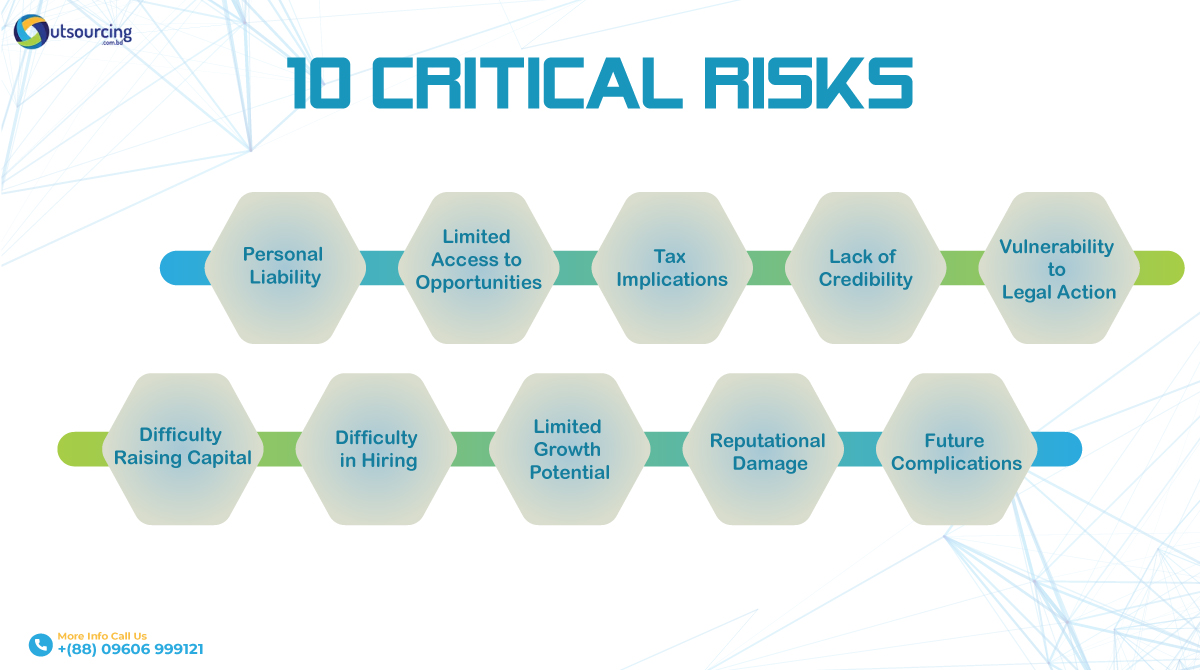

Formalizing your business through registration might seem like a hurdle, but it’s a crucial step for safeguarding your venture and ensuring its smooth operation. Skipping this step can put you and your business at significant risk, potentially leading to severe consequences down the line. Let’s delve into the 10 critical risks of not registering your business:

1. Personal Liability:

One of the most significant drawbacks of operating an unregistered business is the lack of separation between your personal and business assets. This means that if your business incurs debts or faces legal issues, your assets like your car, house, or savings could be on the line to cover them.

2. Limited Access to Opportunities:

Without a formal business registration, you might face difficulties opening bank accounts, obtaining licenses and permits, or entering into contracts with other businesses. This can significantly hinder your ability to grow and operate effectively.

3. Tax Implications:

Unregistered businesses may not be eligible for certain tax benefits and deductions available to registered ones. This could lead to higher tax liabilities and financial burdens for you and your business.

4. Lack of Credibility and Legitimacy:

Operating an unregistered business can raise doubts about your legitimacy and professionalism in the eyes of potential customers, partners, and investors. This can make it harder to build trust and secure business deals.

5. Vulnerability to Legal Action:

Without legal recognition, your business becomes vulnerable to legal challenges from competitors, customers, or even employees. You might not be able to enforce contracts, protect your intellectual property, or take legal action against others if needed.

6. Difficulty Raising Capital:

Investors and lenders are generally hesitant to invest in unregistered businesses due to the associated risks. This can make it challenging to secure funding for growth and expansion.

7. Difficulty in Hiring Employees:

Some employees, especially skilled professionals, may be hesitant to work for an unregistered business due to concerns about job security, benefits, and legal protection.

8. Limited Growth Potential:

Without the ability to access certain resources and opportunities available only to registered businesses, your growth potential might be limited.

9. Reputational Damage:

If your unregistered business faces legal issues or negative publicity, it can damage your reputation and make it harder to attract customers and partners.

10. Future Complications:

Even if you operate an unregistered business successfully for some time, legal or financial complications can arise later, making it difficult to rectify the situation or formalize your business.

Critical Business Formation Risk Mitigation Strategies

Creating a business involves not just the excitement of bringing a new venture to life, but also managing the risks associated with it. Here are seven key points for critical business registration risk mitigation strategies:

Thorough Market and Legal Research:

- Conduct comprehensive market research to understand industry trends and customer needs.

- Familiarize yourself with legal requirements and regulations related to your business.

Choosing the Right Business Structure:

- Evaluate different business structures (like LLC, corporation, and sole proprietorship) for liability protection, tax benefits, and operational flexibility.

Proactive Intellectual Property Protection:

- Register trademarks and patents early to protect your brand and innovations.

- Consider the global aspect of IP protection if you plan to operate internationally.

Compliance with Legal and Tax Obligations:

- Stay informed about local, state, and federal laws affecting your business.

- Ensure timely and accurate tax filings and understand your tax obligations.

Robust Financial Management:

- Implement strong financial controls and bookkeeping practices.

- Regularly review financial statements to monitor the health of your business.

Establishing Strong Contracts and Agreements:

- Draft clear contracts with suppliers, customers, and employees.

- Seek legal advice to ensure contracts are enforceable and protect your interests.

Continuous Risk Assessment and Management:

- Regularly assess potential risks as the business grows and the market evolves.

- Develop a risk management plan that includes insurance coverage and contingency planning.

Why Is Business Registration Important for Your Startup?

Business registration is a pivotal step for any startup, serving as a foundation for its legal and operational framework. It provides legal recognition to the business, distinguishing the owner’s liabilities from the company’s liabilities, thereby offering crucial protection of personal assets.

Furthermore, registered businesses gain enhanced credibility with customers, investors, and financial institutions, which is vital for securing funding, establishing bank accounts, and engaging in formal contracts.

Registration is crucial for protecting a startup’s brand identity and legally safeguarding its name and trademarks from unauthorized use. It also ensures compliance with various laws at local, state, and federal levels, particularly in taxation matters.

This compliance is not just about adhering to legal standards but also about leveraging potential tax benefits and deductions that can significantly impact the financial health of the startup.

5 Common Mistakes to Avoid During Business Registration

Avoiding common mistakes during business registration is crucial for the smooth establishment and operation of a business. Here are five semi-key points to keep in mind:

- Choosing the Wrong Legal Structure: Select the structure that best suits your business goals, liability protection needs, tax implications, and growth potential. Consider sole proprietorships, partnerships, LLCs, or corporations.

- Failing to Conduct a Thorough Name Search: Research to ensure your desired name is available and doesn’t infringe on existing trademarks. Use online tools and consult with your local business registration agency.

- Submitting Incomplete or Inaccurate Information: Double-check all forms and documents for accuracy and completeness. Follow instructions meticulously to avoid delays or rejections.

- Missing Important Deadlines: Stay organized and track filing and renewal deadlines. Submit applications promptly to avoid penalties or potential business suspension.

- Disregarding Ongoing Compliance Requirements: Understand ongoing obligations like tax filings, annual reports, and license renewals. Establish systems to maintain compliance and avoid legal trouble.

6 Hacks for Effortless Business Registration

To streamline the business registration process, consider these six practical hacks:

- Utilize Online Registration Services: Many jurisdictions offer online registration, which can be more efficient than traditional methods.

- Prepare All Documentation in Advance: Gather necessary documents (like ID, proof of address, and business plan) beforehand to avoid delays.

- Seek Professional Assistance: Consulting with a lawyer or an accountant can provide clarity on complex legal and tax issues.

- Opt for a Registered Agent Service: A registered agent can handle legal and official documents, ensuring you never miss important information or deadlines.

- Research Name Availability Thoroughly: Ensure your business name is unique and adheres to legal requirements to avoid future conflicts or rebranding needs.

- Understand and Plan for Your Specific Industry Requirements: Different industries have unique licensing, insurance, and regulation needs; understanding these early on can streamline the registration process.

How Can Business Registration Propel Your Growth?

Business registration boosts a company’s growth by enhancing its credibility and opening up opportunities like easier access to loans and investment capital, as it’s favored by customers, suppliers, investors, and financial institutions.

Moreover, registration safeguards the business’s brand and intellectual property, ensuring exclusive rights over its name and trademarks. This is crucial for marketing and establishing a distinct brand identity in a competitive market.

Registered businesses also benefit from the ability to enter into formal contracts and expand their operations into new markets, including international territories, under legal protection.

Compliance with legal and tax regulations, a consequence of registration, not only avoids potential legal issues but also offers tax advantages that can improve financial efficiency.

5 Tax Benefits of Proper Business Registration

Proper business registration offers several tax benefits, which are crucial for the financial health and efficiency of a company:

- Eligibility for Tax Deductions: Registered businesses can claim various expenses as tax deductions, reducing taxable income.

- Access to Business Tax Credits: Certain registrations may qualify the business for specific tax credits, providing significant savings.

- Structured Tax Planning: Proper registration allows for more effective tax planning strategies, optimizing tax liabilities.

- Avoidance of Penalties and Fines: Being registered helps in complying with tax laws and avoiding penalties associated with non-compliance.

- Potential for Lower Tax Rates: Depending on the structure, some registered businesses benefit from lower corporate tax rates compared to personal tax rates.

Conclusion

Business registration is an essential step for any entrepreneur aiming to build a successful and sustainable enterprise. It legitimizes the business, creating a legal entity distinct from its owners and offering protection for personal assets.

The process of registration opens doors to numerous opportunities, including access to finance, legal protection of the business name and intellectual property, and the ability to engage in formal contracts. Moreover, being registered fosters credibility with customers, suppliers, and investors, which is vital for growth and expansion.

Complying with legal and tax obligations through registration not only avoids potential penalties but also avails various financial benefits, such as tax deductions and credits. Overall, business registration is more than just a legal requirement; it’s a strategic step toward establishing a robust foundation for business growth and longevity.

FAQs

Can I register my business online?

In many jurisdictions, yes. Online registration is increasingly available and can be more convenient and faster than traditional methods.

What is the cost of business registration?

Costs vary based on the type of business structure, location, and specific requirements like licenses or permits. Generally, there are filing fees, and additional costs may apply for legal or professional assistance.

Do I need to renew my business registration?

This depends on your jurisdiction and business structure. Some registrations require annual renewals, while others are one-time processes.