Expanding business internationally has become a popular trend among businesses of all sizes in recent years.

However, offshore company formation services offer to help businesses and individuals which can set up offshore companies in foreign jurisdictions.

The question is, “How does offshore company formation expand your business worldwide?”

Offshore company formation services can be useful for businesses and individuals looking to expand their international presence. Moreover, it can protect their assets, or take advantage of favorable tax laws and other benefits offered by certain offshore jurisdictions.

Let’s crack it below!

How Does Offshore Company Formation Expand Business Worldwide

Offshore company formation can be a powerful tool for expanding your business globally. By setting up an offshore company, you can establish a presence in a foreign jurisdiction and access new markets, customers, and business opportunities.

Although this can help you expand your business globally and grow your customer base beyond your domestic market.

- By setting up an offshore company in a tax-friendly jurisdiction, you can reduce your tax liability and free up more resources to invest in new growth opportunities.

- These companies can also provide enhanced privacy and asset protection, which can be particularly valuable for businesses operating in high-risk industries or markets.

- In addition to these benefits, company formation can provide greater flexibility and control over your business operations.

- Offshore jurisdictions often have less stringent regulations than domestic jurisdictions, which can allow you to operate more efficiently and cost-effectively.

Overall, it’s important to work with a professional offshore company formation service to ensure that your company is set up properly and that you remain in compliance with local laws and regulations.

Approximate Cost of Offshore Company Formation Service

The cost of offshore company formation can vary depending on a variety of factors, including the jurisdiction of incorporation, the level of service required, and any additional fees or charges.

Here are some approximate pricing ideas for company formation:

- Basic offshore company formation: This can cost anywhere from $500 to $1,500 and includes the basic services needed to set up a company, such as registration, a registered agent, and the provision of a registered office address.

- Mid-level company formation: This can cost between $1,500 to $3,000 and may include additional services such as a nominee director, bank account opening assistance, and ongoing compliance support.

- Premium company formation: This can cost upwards of $3,000 and includes a full suite of services to support the establishment and ongoing operation of the offshore company, including multiple directors, shareholders, subsidiaries, and complex structures.

5 Advantages of Offshore Company Formation

Offshore company formation can offer a range of advantages to businesses and individuals, including:

1. Tax Optimization:

Setting up an offshore company can help businesses and individuals reduce their tax liabilities by taking advantage of these tax benefits.

2. Asset Protection:

Offshore companies can also provide asset protection by keeping assets outside of the jurisdiction where the business or individual operates. This can help protect assets from legal action, bankruptcy, and other risks.

3. Privacy:

Offshore company formation can also offer privacy advantages, as some jurisdictions offer greater privacy protection for company owners and shareholders.

4. Lower Costs:

Offshore company formation can often be less expensive than incorporating in a domestic jurisdiction.

5. Global Expansion:

Offshore company formation can also help businesses expand globally by providing a legal structure to operate in multiple countries. This can help businesses take advantage of new markets and opportunities.

However, it is important to ensure that the offshore jurisdiction selected is reputable and compliant with international regulations to avoid any legal or reputational risks.

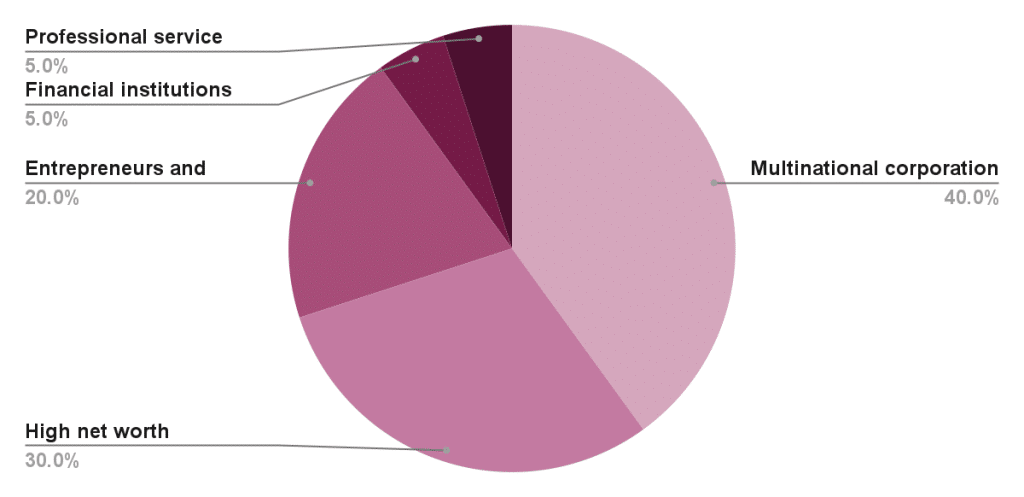

Users of Company Formation (Percentage)

Offshore company formation services can be used by a wide range of businesses and individuals, and these percentages may change over time.

User Group

Percentage

Multinational corporation

40%

High net worth individuals

30%

Entrepreneurs and startups

20%

Financial institutions

5%

Professional service providers

5%

Hiring Offshore Company Formation Service Is So Risky – A Myth

While there are some risks associated with hiring offshore company formation services, it is also true that not all company formation services are risky.

In fact, many reputable and professional service providers offer legitimate and compliant offshore company formation services to businesses and individuals.

These reputable offshore company formation service providers operate in jurisdictions that are well-regulated and compliant with international regulations.

Moreover, they have a deep understanding of the legal and regulatory framework of the offshore jurisdiction, and they are able to provide expert guidance and support to their clients to ensure compliance and minimize risk.

To ensure that the offshore company formation service provider is reputable and compliant, it is important to conduct thorough research and financial due diligence.

Tips Before Hiring Company Registration Service

Here are some tips to consider before hiring a company registration service:

1. Research the provider:

Do your research and gather information about the provider’s reputation, experience, and track record. Check online reviews, testimonials, and ask for references from past clients.

2. Check the provider’s credentials:

Verify that the provider is licensed and registered to offer company registration services in the relevant jurisdiction.

3. Consider the provider’s expertise:

Look for a provider that specializes in the specific type of company registration you need.

4. Evaluate the provider’s customer service:

Consider the provider’s responsiveness, communication skills, and availability. A good company registration service should be able to answer your questions and provide support throughout the process.

5. Review the service agreement:

Before signing any contract or agreement, make sure you understand the terms and conditions of the service. Review the scope of work, fees, and timelines.

To Sum Up

Offshore company formation services can be an effective way to establish a presence in a foreign market. It takes advantage of the many benefits that come with operating a business in a different jurisdiction.

Offshore company formation services can offer numerous benefits, including lower taxes, greater privacy, asset protection, and access to international markets. Contact us to hire our service to minimize risk.

FAQs

1. Do you pay taxes to an offshore company?

Due to the lower incorporation costs, offshore companies choose tax-friendly or tax-exempt jurisdictions. Businesses can look into a variety of structures, including limited companies, partnerships, and sole proprietorships, depending on the type of financing. Incorporating them is quicker and less expensive.

2. Are offshore businesses legal?

If done for legitimate reasons, using a bank’s services outside of your native country is not against the law. Due to compliance requirements, some foreign banks will open an account from a foreign client with as little as $300, while others won’t do any business at all with them.

3. Is an offshore company an LLC?

A corporation established in a low- or no-tax jurisdiction is simply referred to as an offshore company. There are two main types of offshore corporations: IBCs and LLCs. Practically, these two categories of entities are similar to one another.