Offshore Bookkeeping Services Explained in Simple Steps

Nobody begins a business with the intention of doing their own bookkeeping. Outsourced bookkeeping frees up time for you to focus on running your business, exploring new development prospects, or simply resting and relaxing from the demands of entrepreneurship.

You also have access to the crucial reports and financial statements that any business owner should know about with offshore bookkeeping: financial statements, income statements, and statement of cash flows.

In 2021, 38% of small businesses have outsourced bookkeeping.

FOCUS POINTS:

- Outsourced bookkeeping helps businesses save labor costs, such as employee pay, overhead, equipment, and technology.

- Companies also employ offshore bookkeeping to focus on the essential components of their business while outsourcing the less critical procedures to third parties.

- Some businesses will use a bookkeeping outsourcing company to help them reorganize their balance sheets.

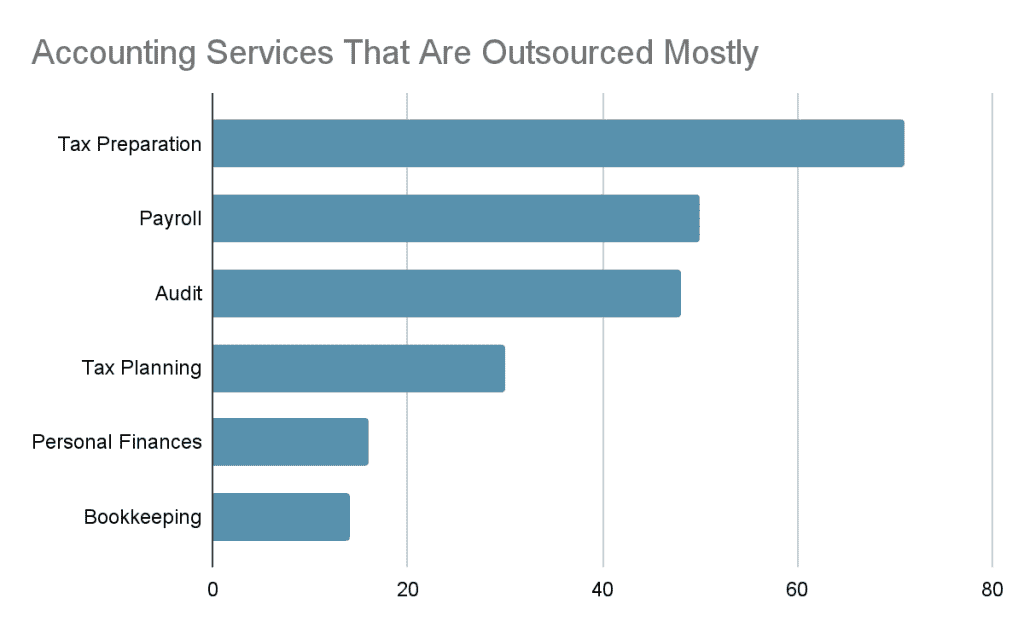

What Accounting Services Do Companies Outsource The Most?

A Complete Guideline Towards Offshore Bookkeeping Services

The method may alter depending on whether you choose to outsource offshore bookkeeping to an individual professional bookkeeping outsourcing company, a human-only service, or a hybrid bookkeeping outsourcing service.

- Make it clear if you have any specific requirements when consulting any bookkeeping outsourcing company.

- When you engage offshore bookkeeping services, you’ll probably be presented with a number of payment alternatives. Pick wisely.

- Throughout the bookkeeping outsourcing process, complete transparency is required.

- Accounting firms must be digitally savvy in order to be competitive.

- You can’t hire a bookkeeper unless you’re confident that your company’s financial data is safe.

- Perform a background check on the outsourced bookkeeping firm you’re thinking about hiring.

- The offshore bookkeeping services should be knowledgeable with the company’s services.

How Bookkeeping Services Can Streamline Your Financial Processes

Bookkeeping services can be invaluable in streamlining any business’s financial processes. A bookkeeper is trained in keeping accurate records of all financial transactions, including revenues, expenses, and investments. This ensures that the finances of the business are always tracked and updated.

Additionally, bookkeeping services provide the tools necessary for businesses to comfortably navigate the world of accounting and tax compliance. With up–to–date records of transactions, businesses can keep detailed records of their financial activity and accurately track their financial health.

A bookkeeper can help organize daily transactions, manage accounts payable and accounts receivable, reconcile bank statements, and prepare financial reports. Ultimately, bookkeeping services allow businesses to enjoy an efficient, accurate, and organized financial process.

Benefits of Bookkeeping Services

1. Increased Accuracy: When you outsource your bookkeeping, you get the benefit of an experienced bookkeeper familiar with all aspects of accounting. This means that your financial information is much more likely to be accurate and up to date, reducing the likelihood of errors and oversights.

2. Time Savings: Bookkeeping can often take up vast amounts of time, especially if it’s not an area of expertise for the owner or manager. By outsourcing your bookkeeping to a professional service, you can relax knowing that the numbers are being properly taken care of, giving you more time to focus on running your business.

3. Expertise & Advice: A qualified bookkeeper can offer invaluable advice on improving cash flow, systems optimization, tax strategies, financial projections, and more. In other words, you can hire professionals who understand the ins and outs of the bookkeeping field and utilize their knowledge to benefit your business in more ways than one.

4. Cost Savings: Managing and maintaining a bookkeeping system on your own can require large amounts of time, labor, and resources. Hiring a bookkeeping service can drastically reduce costs associated with this, as most services offer efficiency and cost-effectiveness in their services.

5. Stress Reduction: Bookkeeping can be complex and overwhelming for many business owners. It can be difficult to ensure that the proper records and documents are handled properly. By outsourcing bookkeeping, you can reduce the tremendous stress that comes with handling finances.

Growing Your Business with Professional Bookkeeping Services

A professional bookkeeping service has the expertise and experience to help businesses in growing their business. This type of service helps businesses take control of their finances and keep track of their income and expenses. Professional bookkeepers provide insight into the financial health of a business and can provide unique solutions on how to improve it.

Furthermore, a professional bookkeeping service can help businesses create plans for maximizing profitability. These plans can include steps for increasing revenue, controlling costs, identifying and leveraging available resources, managing cash flow, and more. In addition, a bookkeeper can help businesses make more intelligent decisions and reduce costs by providing valuable insights and suggestions.

Finally, having a professional bookkeeping service on–site can improve a business‘s entire financial management process. A bookkeeper can help businesses stay on top of their finances, manage their expenses, and review financial reports. A professional bookkeeper can help businesses in growing their business and achieving success.

Top Reasons to Hire a Bookkeeping Service

- Expertise and Accuracy: Hiring a bookkeeping service provides access to professionals with specialized knowledge and expertise in handling financial transactions. They are train to accurately record and categorize transactions, ensuring that your books are accurate and up to date.

- Time and Efficiency: Bookkeeping can be time-consuming, especially for small business owners who have to juggle multiple responsibilities. Outsourcing your bookkeeping allows you to focus on core business activities while leaving the financial record-keeping to experts.

- Compliance and Avoidance of Penalties: Professional bookkeepers are well-verse in tax regulations, financial reporting standards, and compliance requirements. They can help ensure that your business meets all necessary financial obligations. Reducing the risk of errors or omissions that could result in penalties or legal issues.

Bottom Line

The most important consideration when choosing offshore bookkeeping services is determining which services will be able to assist your company as it grows and expands.

Offshore bookkeeping and accounting has benefits and drawbacks. A corporation should inquire about the service provider’s knowledge, talents, experience, pricing, and online billing software before selecting to outsource bookkeeping or accounting services. So contact us today to get exactly what you have been needing!