Businesses are being forced to find new ways to comply while still meeting customer demands in a competitive and effective manner. As the global corporate, regulatory, and technological environment is rapidly changing.

Hence, the question is, “Does accounting outsourcing service hamper your credibility?”

Accounting outsourcing can provide a higher level of privacy than an internal employee. A qualified accounting and finance outsourcing company can implement remedies to address current challenges to data security.

Let’s discuss it without delay!

How Do Outsourced Accounting Services Protect Credibility?

The confidentiality and privacy of their clients are superbly preserved by accounting outsourcing companies. You should outsource accounting and finance functions to grow your company.

So, you’ll have more time to concentrate on other important duties like bringing in money, creating business plans, or making strategic decisions because of the trustworthy back-office support.

Although fraud cannot entirely be avoided by businesses, highly trained and experienced accountants are more likely to spot discrepancies than those who only consider increasing sales and growing the company.

You get skilled individuals to work for you in creating a risk-free payment and accounting system without having to hire accountants.

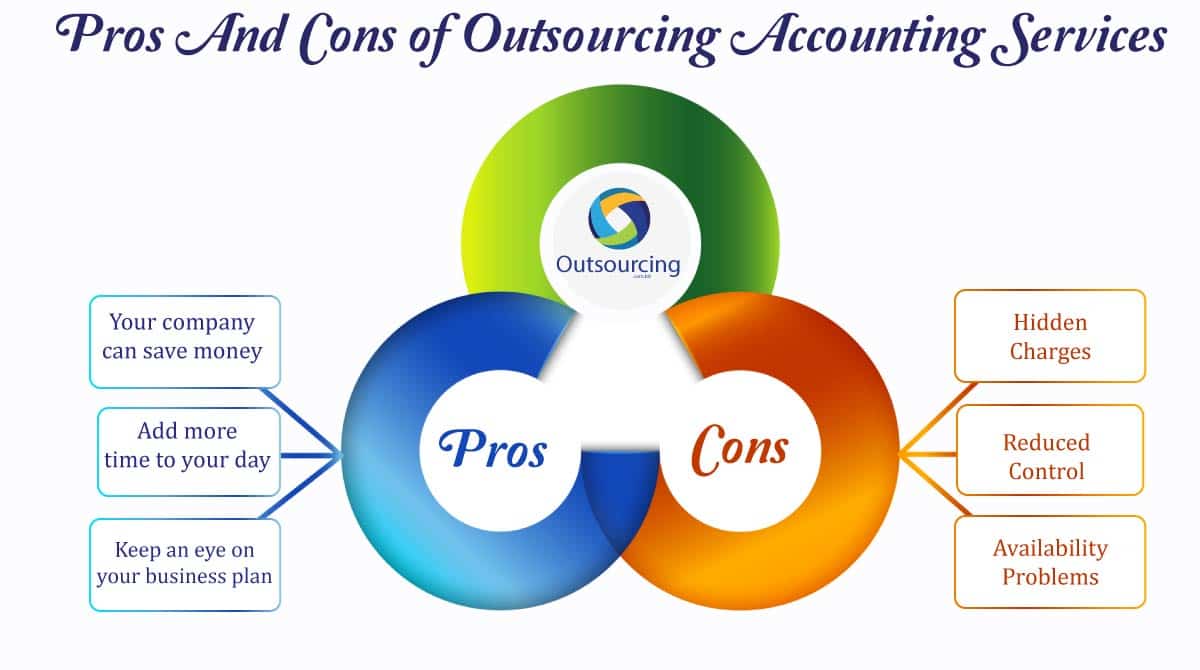

Pros And Cons of Outsourcing Accounting Services

Pros:

1. Your company can save money: Accounting services can be more cost-effectively outsourced since they give your business access to high-caliber, skilled financial professionals for a small amount of money.

2. Add more time to your day: The management of financial operations that are currently done internally can be handled by an outsourced accounting specialist.

3. Actively keep an eye on your business plan: The right procedures can be put in place when you opt to use an accounting service.

So, ensuring that you have complete visibility of the key indicators you need to make crucial business decisions swiftly and effectively.

Cons:

- Hidden Charges: With every paid service, scope creep is possible. One activity might turn into several as a result of a snowball effect, resulting in extra expenses that business owners were not aware of at the beginning.

- Reduced Control: For business owners, giving over control of their financial data to a third party can be challenging.

- Availability Problems: Having a worker on staff who can reply to questions swiftly has several benefits. Despite being easily accessible, an outsourced workforce does not necessarily provide prompt service.

Who Needs to Hire Finance and Accounting Outsourcing

In the past, only huge corporations outsource their accounting. However, it’s now accessible to smaller firms and organizations because of technological developments and increased public awareness of remote workers.

1. Small-scale companies:

A small business owner who needs more than the current office manager, bookkeeper, or administrative staff can provide but does not need a full-time accountant and chief financial officer.

2. New Businesses:

A developing business seeking to improve its accounting or financial capabilities.

3. People Who Need Short-Term Assistance:

A corporation or owner who just requires temporary assistance.

4. Non-Profit Organizations & Charities:

It has extensive experience in not-for-profit accounting and is knowledgeable with managing donations and tax-deductible receipts.

FAQs

1. What financial services can be outsourced?

Bookkeeping, accounting audit, forensic accounting, management accounting, tax accounting, payroll services, statutory reporting, and compliance.

2. Is accounting outsourcing less expensive?

As opposed to engaging internal people to perform the financial function, hiring an outsourced accounting firm is frequently more affordable and cost-effective.

3. What categories of accountants are most prominent?

Accounting for taxes, accounting for finances, and accounting for management.

Conclusion

The outsourced finance and accounting sector has started to earn the trust of businesses of all sizes and types by continuing to show them how valuable it is. As a result, many businesses are now increasingly eager to outsource difficult financial tasks.

Instead of only outsourcing bookkeeping services, businesses are now searching for partners to assist them in project valuations, cash flow models, and other complicated financial operations.

Request a trial right away to talk about outsourcing your finances and accounting and our adaptable solutions.