Payroll Outsourcing: The Good And The Evil

The employment of managed payroll services to manage the administrative and compliance functions of paying staff is known as payroll outsourcing.

It’s vital to realise that payroll services are just that: they don’t provide the overseas company with a local employer of record. This means that local corporations are still needed, and the rest of the aspects of hiring personnel must be done on your own or by professionals.

The global payroll outsourcing industry was worth $85.6 billion in 2018.

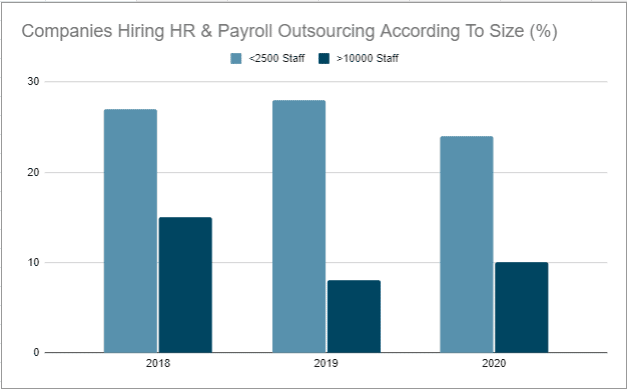

Companies Hiring Payroll Outsourcing Services According To Their Sizes

Small organisations are more likely to hire outsourced payroll providers than bigger organisations. Let’s see how it went in past 3 years:

Advantages of Payroll Outsourcing

Payroll outsourcing is a practice used by businesses of all sizes to reduce the time spent on administrative tasks and to ensure compliance with tax laws. Here are some of the primary advantages:

- Time Savings: Payroll processing inside your business can consume a significant amount of time each pay period. Outsourcing frees up these hours for more important, strategic tasks.

- Cost Reduction: For many businesses, the cost of outsourcing payroll is less than the cost of maintaining it internally, especially when considering the time that is spent on these tasks.

- Improved Compliance: Outsourcing companies are experts in the field of government regulations, taxes, and the like. They can ensure that your company stays in compliance with the latest rules and regulations.

- Expertise on Your Side: Payroll companies have seen it all. They bring expertise in a variety of areas, including human resources, tax regulations, and technology.

- Access to Advanced Technology: Most business owners don’t have time to research the latest payroll software and technology. When you outsource, you get access to advanced technology as part of the package.

Risks Of Outsourced Payroll Providers

- While many HR and payroll outsourced payroll providers offer 24/7 support to guarantee you’re never caught off guard in a payroll situation, certain employees may find the absence of face-to-face interaction to be a source of frustration.

- Managed payroll services come with a loss of control, and you’ll be allowing another company access to your team’s sensitive information, which may not be ideal for your organisation.

- The notion that your selected payroll outsourcing services no longer need your help is the most likely to cause problems.

Barriers Of Payroll Outsourcing

- The issue of in-house versus outsourced payroll services:

Despite the numerous benefits that Payroll Outsourcing may provide, there are concerns that things may go wrong. It is difficult to preserve the sense of confidence that one develops with in-house personnel when outsourcing. - Choosing the best payroll outsourcing services provider:

After you’ve decided to use managed payroll services, the following step is to choose a suitable outsourcer. There are a slew of Payroll Outsourcing Companies vying for your business. However, you must hire the one who satisfies your specific requirements. - Assessing the cost-effectiveness of hr and payroll outsourcing services:

It’s possible that the value of payroll outsourcing services will exceed your expectations. Will your payroll outsourcing firm save you money while providing you with high-quality services? A cost-benefit analysis is the answer to this question. - Payroll outsourcing services’ dependability:

HR and payroll services from a company that is based far away may cause confusion. You can get a sense of if the HR and outsourcing company you choose is trustworthy.

Overcoming The Challenges

- The best way to solve the first issue is to make a complete list of the pros and cons of the two service possibilities. To reach a final decision about outsourcing, you should examine the available financial resources as well as the needs of your company.

- With the help of a checklist, you can evaluate the various possibilities. Look for well-known businesses on review sites such as Clutch.

- It is critical to ensure that the outsourcing services option is appropriate for your company. It’s also a good idea to compare the costs of in-house payroll services against outsourcing.

FOCUS POINTS:

- Tracking employee hours worked, computing pay, and sending payments by direct deposit or check are all part of the payroll outsourcing services.

- Companies must, however, complete accounting and record-keeping, as well as set aside funds for Medicaid, Social Security, and unemployment benefits levies.

- If a company does not want to handle it themselves, it can hire outsourced payroll providers or use cloud-based software.

We Are Here To Help

Because it recruits experts in the particular field of requirements, Our payroll outsourcing business ensures greater performance. It’s like having a complete company working for you, but without the inconvenience of needing to be physically present. By hiring our payroll outsourcing services, you not only improve the efficiency of the process, but you also obtain expert oversight to avoid costly mistakes. We ensure standardisation, centralization, and uniformity of payroll processes across all branches for multinational corporations operating in several countries.