A Strategic Formation of Incorporated a Limited Company

Greatest Bangladesh company are register as much private limited liability companies generally known as private limited companies. Accordingly a Offshore Limited Company in Bangladesh is an individual lawful legitimate and shareholder are not responsible for the company debts beyond the quantity of share capital they have contribute. Following to the companies act 1994 foreign or local any person and upon the age 18 can register a offshore limited company in Bangladesh.

We provide expert business incorporation services to help you establish your company efficiently and in full compliance with local regulations.

Stay With Our Incorporate In Best Taxation Service Company

At first if you come to entity incorporation in Bangladesh one of the greatest introduce options to start a business is to take reports to incorporate a Offshore Limited Company in Bangladesh. Though there are many other choices to start business in Bangladesh of which the greatest normal and useful process are either incorporate a Offshore Limited Company in Bangladesh. Before moving on to the method of register a private limited company in Bangladesh investment development authority that is generally known as BIDA.

However, to handle as a liaison office in Bangladesh, such as simply the liaison office in Bangladesh liaison between its parent firm and other possible or client but when it comes to building business transaction only the parent company can manage under the supervise of the Bangladesh bank and other pertinent authorities as a foreign company. So, unless or until the parent firm incorporate outside of Bangladesh simply wants to establish a degree of communication with the service advisor in Bangladesh.

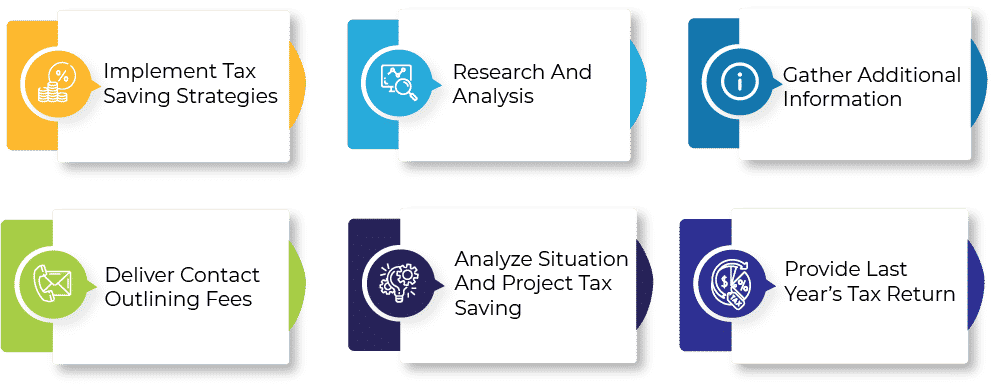

We Grow Your Business In 6 Successful Steps:

Once the denoting a thing or person previously mention formalities are comply with registrant of joint stock company take steps with the certificate of incorporation within 6-8 working days. It generally takes 2-3 weeks to register a offshore limited company from the date of submit all the documents to registrant of joint stock company. Once the name clearance is obtain, the clearance remains valid for 6 months. Obtaining a name approval generally takes three working days.

After that getting the Name Clearance certificate, you’ll need to register a bank account and transfer the initial paid up capital from the shareholder account. Particularly if there is any foreign direct investment, the sum for paid up capital must be transmit via the newly form bank account in accordance with the require procedures. As well as the fees for register a offshore limited company with the government are determine by the amount of authorize capital. The government will charge BDT 1000 for the issue of an incorporation certificate.