Concentrate On Matters Of Strategic Importance To Your Business With Our Tax Equalization Services

Bangladesh implements a tax equalization policy for foreign employees working in this country. When an expatriate uses tax equalization, he/she counts taxes for both native and abroad nation’s taxation. However, it is a vague process that can bring failure to the overall taxation procedure.

To streamline this operation and to get rid of huge tax equalization gaps outsourcing your tax processes from OutsourcingBD. This firm can be the most reliable partner for your tax sector. With their professional hands, taxation may turn smooth and accurate in a quick turnaround time.

Obtain Our Tax Equalization Services To Decide Most Efficient Approach To Align Your Business & Commercial Needs

Our Expert Team Ensure Tax Equalization Policy & Tax Protection Policy Design & Review Successfully

Our Trusty Tax Assistance & Consultancy Service For Your Better Productivity

Corporate tax Taxation policy is different for an employee who is working in Bangladesh. They have to pay double taxation for the tax equalization process. Tax equalization tries to remove the tax rates of foreign workers in Bangladesh.

It is called hypo tax. The workers pay taxes as if they reside in this country like natives. Bangladesh has made double taxation treaties with 34 countries.

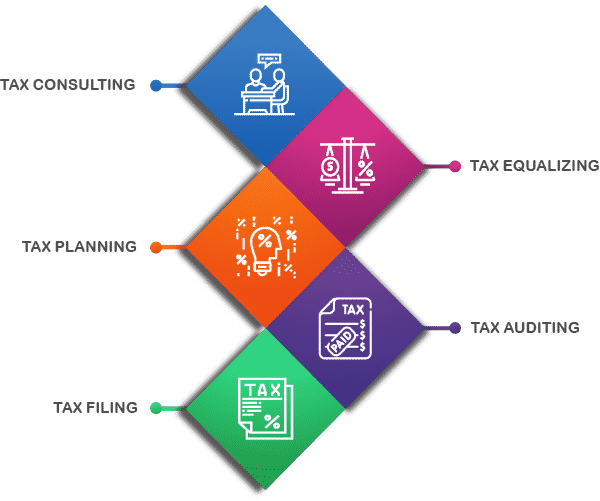

OutsourcingBD is a professional advisory, tax consulting, and accounting services company in Bangladesh. Here taxation-related services include tax equalization, corporate tax planning, tax auditing, tax filing, and many more. With our assistance in the tax field, you don’t need to worry about the implications of taxation for your company. We ensure compliance under applicable laws.

How We Can Help With Your Tax Equalization Needs Effectively?

Frequent changes in the tax system make it much complex in Bangladesh. OutsourcingBD provides an efficient tax consultancy service. It resolves complexities for all types of clients. Our tax services for foreign entrepreneurs in Bangladesh are:

For Employers

For Employees