Get Ready To Take Our eSourcing Supply Chain Services For Your Valuable Business

Finding, assessing, selecting, and cooperating with present and also prospective distributor is the business practice of sourcing. Our eSourcing supply chain management add an electronic component to commerce that is handle online in a web base platform,. Which is the industry standard in todays digital world.

From negotiation to contract administration, OutsourcingBD manage all facet of esourcing supply chain strategy. Buyer gather data on distributor, such as their product, service, and pricing. Our esourcing supply chain management software organize, normalize, and compile the data. So that we may make realistic comparison base on what buyer require.

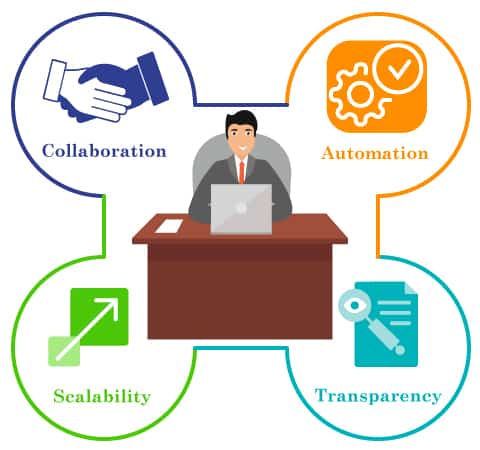

Our Unique Approach To eSourcing Supply Chain Management

Our online support for defining supplier selection criteria (Request for Information, RFI), inviting potential distributor to tender, performing tender processes (Request for Proposal, RFP, and/or Request for Quotation, RFQ). At the same time running eAuctions, analyzing and evaluating responses, and finally awarding contracts is include in our esourcing supply chain management process.

5 Advantages Of Our eSourcing Supply Chain Management Services